BESTSELLING AUTHOR & AWARD WINNING WEALTH MANAGER

An independent private office providing financial advice, investment management & tax efficient estate succession solutions

Helped 323 clients over the last 21 years

Avoiding 3 common mistakes that see many people run out of money, pay thousands in unnecessary fees and leave no legacy for heirs

Key Strategies to Preserve Wealth and Ensure Financial Security for Future Generations

Fixed Income Syndrome

Allocating too much of pensions and other investments to fixed-income bonds and gilts, could limit potential growth and result in your funds failing to keep pace with inflation, eroding purchasing power

Active Management Drag

Advisers who deploy actively managed investments or funds may jeopardise your goals, as they incur higher management fees and trading costs, and mostly underperform passive alternatives

Fat Cat Excess

Using an adviser affiliated with a financial network might result in excessive fees covering the cost of layered management and flagship offices, diminishing your investment returns over time

Latest UK Investment Stats

Explore the latest key figures within the UK investment landscape. These statistics provide valuable insights into market trends and the investment challenges we highlight, helping you make informed decisions.

* data used with permission

General Investment Portfolios

- The Investment Association October 2024

- The Investment Association October 2024

- The Investment Association October 2024

- Internal Research April 2024

A lifetime financial partner

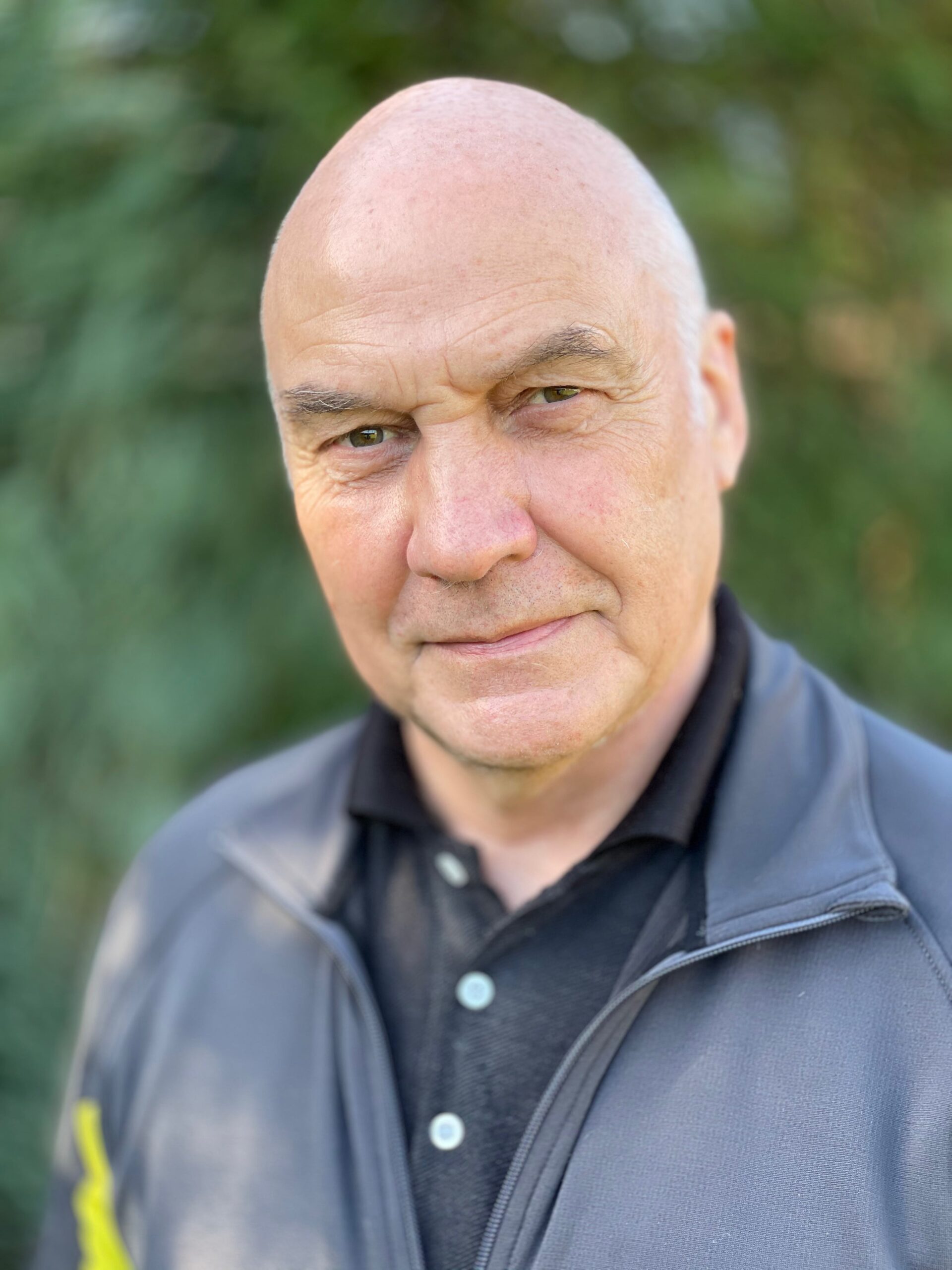

Martin Wilcocks is an esteemed adviser and bestselling author with over three decades of experience in banking and wealth management. Thanks to exceptional work with clients, his expertise he has been featured in The Times, The Telegraph, and The Mail on Sunday, earning him a place among an elite tier of advisers in the UK.

Our office specialises in working with men and women who are approaching or transitioning into retirement – particularly those who find themselves in one or more of the following situations:

- Overweight in fixed-income corporate bond or gilt investments, or both

- Have an investment portfolio managed by a fund picker, or stockbroker

- Supported by an adviser operating within an expensive financial network

If that sounds like you, we are well positioned to transform your financial position. We focus on protecting what exists today, building tomorrow’s wealth, and ensuring a safe intergenerational transfer of assets to your family and other beneficiaries.

Personal Finance

Financial Retirement Planning

Financial Risk Management

The Solution

EVEST™

Evidence Based Investment

Fees: 2% on new capital & 1% per annum

Leveraging Nobel prize-winning research, EVEST™ delivers an investment solution utilising institutional-grade funds typically unavailable to retail investors

Proven Investment Strategies with a Solid Track Record

Leveraging Award-Winning Insights for Optimal Returns

Access Investment Funds typically unavailable to retail investors

JON MCHALE

DIRECTOR, TAG SCAFFOLDING LTD

JAMES QUILTY

KELSALL SERVICES LTD & DJ JAYQ

FRANK BRENNAN

DIRECTOR, SAFETY LANE LTD

SIMON LAKIN

WEST KIRBY

MARIANNE LYON

ORMSKIRK

IAN CROMBLEHOME

MAGHULL

DR STEPHEN DOWNES

WOOLTON

BRIAN STAUNTON

SEVENOAKS

ANDY PERRY

KNOWSLEY

MARK FOSTER

MANAGING PARTNER, FOSTERS LAWYERS

PHIL O’NEILL

WIRRAL

DR NAVAID ALAM

WIRRAL

DR RICHARD AZURDIA

WIRRAL

HUGH MCAULEY

RETIRED PROFESSIONAL FOOTBALLER

ROY JOHNSON

PROFESSIONAL GOLFER, WIRRAL

MARY ELSON

HIGHER PENLEY

NIGEL LACEY

STOURBRIDGE

JON MCHALE

DIRECTOR, TAG SCAFFOLDING LTD

JAMES QUILTY

KELSALL SERVICES LTD & DJ JAYQ

FRANK BRENNAN

DIRECTOR, SAFETY LANE LTD

SIMON LAKIN

WEST KIRBY

MARIANNE LYON

ORMSKIRK

IAN CROMBLEHOME

MAGHULL

DR STEPHEN DOWNES

WOOLTON

BRIAN STAUNTON

SEVENOAKS

ANDY PERRY

KNOWSLEY

MARK FOSTER

MANAGING PARTNER, FOSTERS LAWYERS

PHIL O’NEILL

WIRRAL

DR NAVAID ALAM

WIRRAL

DR RICHARD AZURDIA

WIRRAL

HUGH MCAULEY

RETIRED PROFESSIONAL FOOTBALLER

ROY JOHNSON

PROFESSIONAL GOLFER, WIRRAL

MARY ELSON

HIGHER PENLEY

NIGEL LACEY

STOURBRIDGE

JON MCHALE

DIRECTOR, TAG SCAFFOLDING LTD

JAMES QUILTY

KELSALL SERVICES LTD & DJ JAYQ

FRANK BRENNAN

DIRECTOR, SAFETY LANE LTD

Join Our Waiting List Today

Exclusive: By Invitation Only

Due to overwhelming demand, we have paused new client onboarding and now operate on an invitation-only basis. This exclusive approach ensures that we maintain the highest quality of service and personalised attention for our esteemed clients.

Secure your place on our waiting list for a chance to be invited

2022

2023

2024

Team work makes the dream work

Collaborative Efforts for Superior Outcomes

Mary Wilcocks

Executive Assistant

Martin Wilcocks

Wealth Manager

Tahnee Macfarlane

Office Manager

Invest online with Wilcocks & Wilcocks

Whilst the onboarding of new client relationships has been paused, we have provided access to EVEST™ through our direct investment portal, allowing you to invest in our institutional-grade investment model online. Our initial advice is free, entirely online, and anonymous. You can fast-track your way to a bespoke relationship by starting today with either a lump sum or a monthly contribution into an ISA or General Investment Account. Click through to get started

The benefits are just a few steps away

SOLD OUT

Tap into the evidence based investment strategy available as part of our full advised service

My book for financial, investment and estate planning tips, guidance and non advised advice

book a call

with us today

Have a glance at the calendar and select a slot that works for you

Hear what our Clients have to say

Our clients’ reflect real people, achieving real results, through real solutions…

Excellent service from the team.

Elaine Cooper

Elaine Cooper

Excellent service from the team.

I cannot tell you how much I appreciate what Martin has done for my family. He has gone above and beyond in the most honourable way. He is an absolute credit to his profession.

Michelle Moore

Michelle Moore

I cannot tell you how much I appreciate what Martin has done for my family. He has gone above and beyond in the most honourable way. He is an absolute credit to his profession.

“Martin is the consummate professional who has always delivered for myself and my business partner Joe Dwek CBE.”

ROY KENNY

ROY KENNY

“Martin is the consummate professional who has always delivered for myself and my business partner Joe Dwek CBE.”

“He provided very good advice on how to fund our pensions through the company to save Corporation Tax.”

ADAM MULLIN

ADAM MULLIN

“He provided very good advice on how to fund our pensions through the company to save Corporation Tax.”

“Martin is a breath of fresh air, explains things properly and his advice has been first class.”

ROSS BAIGENT

ROSS BAIGENT

“Martin is a breath of fresh air, explains things properly and his advice has been first class.”

“We insured our shareholdings, and through a trust it allows the four of us to buy back each other’s shares on death, or illness, which is very important for the company to keep control, but also for our families, who receive the value of each shareholding as a lump sum.”

STEVE DUNN

STEVE DUNN

“We insured our shareholdings, and through a trust it allows the four of us to buy back each other’s shares on death, or illness, which is very important for the company to keep control, but also for our families, who receive the value of each shareholding as a lump sum.”

“We know exactly how much money we need to build within our financial and retirement plan to achieve our future income goals.”

COLLIN DORAN

COLLIN DORAN

“We know exactly how much money we need to build within our financial and retirement plan to achieve our future income goals.”

“We consolidated a batch of old pensions that I had built up over the years. Alongside that, if I was to be seriously ill the business profit would drop so we arranged key man insurance for 2 years profit if the worst happens. Working with Martin has been a great move for us.”

JEFF ARNOLD

JEFF ARNOLD

“We consolidated a batch of old pensions that I had built up over the years. Alongside that, if I was to be seriously ill the business profit would drop so we arranged key man insurance for 2 years profit if the worst happens. Working with Martin has been a great move for us.”

“Martin tidied up and consolidated 5 old pensions and I now understand where they invest, what I pay in charges and how much they will provide in retirement. I can’t recommend him highly enough.”

CHRIS MOSS

CHRIS MOSS

“Martin tidied up and consolidated 5 old pensions and I now understand where they invest, what I pay in charges and how much they will provide in retirement. I can’t recommend him highly enough.”

“He handles our investments and pensions. We are very happy and value Martin’s advice which has also more recently involved us making a will and business trust and in also appointing powers of attorney.”

BALAZS & KATE HORVATH

BALAZS & KATE HORVATH

“He handles our investments and pensions. We are very happy and value Martin’s advice which has also more recently involved us making a will and business trust and in also appointing powers of attorney.”

“Martin arranged the finance I needed to buy the White Lion Pub – the last free house on the Wirral. It had always been in my plan but due to banks not funding pubs I was stuck and Martin sorted it.”

ANDY COCKRAM

ANDY COCKRAM

“Martin arranged the finance I needed to buy the White Lion Pub – the last free house on the Wirral. It had always been in my plan but due to banks not funding pubs I was stuck and Martin sorted it.”

“Martin gave me sound and simple investment advice that made sense and within my financial plan we have also worked out when I can retire and buy my sailing boat.”

STEPHEN LACEY

STEPHEN LACEY

“Martin gave me sound and simple investment advice that made sense and within my financial plan we have also worked out when I can retire and buy my sailing boat.”

“Martin has spent time with the children so they understand our retirement financial plan. He has been a big help to our family in general.”

HELEN LACEY

HELEN LACEY

“Martin has spent time with the children so they understand our retirement financial plan. He has been a big help to our family in general.”

“Every client we have passed to Martin has been very happy. It’s not easy to find a good Financial Adviser and I think Martin has proved time and again he is one of the good guys.”

BEN EDWARDS

BEN EDWARDS

“Every client we have passed to Martin has been very happy. It’s not easy to find a good Financial Adviser and I think Martin has proved time and again he is one of the good guys.”

“I was looking to work with a trustworthy and knowledgeable Financial Advisor, capable of dealing with our clients. Martin ticks the boxes on both counts, coupled with a high degree of professionalism and integrity.”

PAUL WHITE

PAUL WHITE

“I was looking to work with a trustworthy and knowledgeable Financial Advisor, capable of dealing with our clients. Martin ticks the boxes on both counts, coupled with a high degree of professionalism and integrity.”

“Martin is a competent financial adviser who stands out from the crowd.”

MICHAEL COLLINS

MICHAEL COLLINS

“Martin is a competent financial adviser who stands out from the crowd.”

“Martin is exceptionally accurate in everything that he says and does, I cannot find fault with his advice and I trust him absolutely in his judgement.”

ANDREW THOMPSON FCA

ANDREW THOMPSON FCA

“Martin is exceptionally accurate in everything that he says and does, I cannot find fault with his advice and I trust him absolutely in his judgement.”

“We couldn’t thank Martin enough for his time and the fact that he took personal ownership and pride in making sure we were happy with the pension and investment strategy.”

JON TAYLOR

JON TAYLOR

“We couldn’t thank Martin enough for his time and the fact that he took personal ownership and pride in making sure we were happy with the pension and investment strategy.”

“I took investment and pension advice from Martin. By working out my risk tolerances and setting up my investments he delivered a sound portfolio that I am confident with.”

DAVID TOURNAFOND

DAVID TOURNAFOND

“I took investment and pension advice from Martin. By working out my risk tolerances and setting up my investments he delivered a sound portfolio that I am confident with.”

“In handling our retirement plans, Martin explained how the world of money works and provided a hitherto unknown level of transparency.”

DAVID & ROSEMARY OWEN

DAVID & ROSEMARY OWEN

“In handling our retirement plans, Martin explained how the world of money works and provided a hitherto unknown level of transparency.”

“Martin gave me a very clear understanding of how he would transfer my pension and how it would be invested.”

DAMEON HULSE

DAMEON HULSE

“Martin gave me a very clear understanding of how he would transfer my pension and how it would be invested.”

“He invested for me and I’m very satisfied with his advice and management of my portfolio. I am very impressed with Martin and his dedication to his job. Well done. Keep up the good work.”

ROSEMARY COLCHESTER

ROSEMARY COLCHESTER

“He invested for me and I’m very satisfied with his advice and management of my portfolio. I am very impressed with Martin and his dedication to his job. Well done. Keep up the good work.”

“He explained his pension plan in full detail and went over every step that he would be taking to move across and manage my funds. I am very happy with Martin.”

SHERYL MOSS

SHERYL MOSS

“He explained his pension plan in full detail and went over every step that he would be taking to move across and manage my funds. I am very happy with Martin.”

“Martin is direct and gives you the facts as he sees them. He didn’t try to sway me to pick something with which I would have been uncomfortable.”

STEPHEN LINDEN & CATHY HOOD

STEPHEN LINDEN & CATHY HOOD

“Martin is direct and gives you the facts as he sees them. He didn’t try to sway me to pick something with which I would have been uncomfortable.”

“I took early retirement and wanted two pensions and an ISA amalgamated in a way that would fund my retirement. With Martin on board, we don’t see any problems achieving what we are aiming for.”

DAVE & ANN MCCANN

DAVE & ANN MCCANN

“I took early retirement and wanted two pensions and an ISA amalgamated in a way that would fund my retirement. With Martin on board, we don’t see any problems achieving what we are aiming for.”

“He provided peace of mind around retirement and our future income and everything was explained in a constructive manner, which included any possible downturns. Thank you for the advice its great to be on board.”

DAVE & LYNN MORRIS

DAVE & LYNN MORRIS

“He provided peace of mind around retirement and our future income and everything was explained in a constructive manner, which included any possible downturns. Thank you for the advice its great to be on board.”

“Since the day we had our first meeting with Martin he has demonstrated a personal and proactive approach. Hopefully, we are at the beginning of a very long and successful relationship with Martin and the team.”

ANDY & ANGELA PERRY

ANDY & ANGELA PERRY

“Since the day we had our first meeting with Martin he has demonstrated a personal and proactive approach. Hopefully, we are at the beginning of a very long and successful relationship with Martin and the team.”

My pension is in good hands and over the years I can say without any doubt that Martin is the best financial adviser I've come across.

Ian Cooke-McGuinness

Ian Cooke-McGuinness

My pension is in good hands and over the years I can say without any doubt that Martin is the best financial adviser I've come across.

When I first approached Martin I had a very limited understanding of savings and investments. He provided clarity, assurance and a clear plan to allow me to save and invest on terms that I felt comfortable with. The ongoing administrative support from Mary has been exceptional, she provides very quick replies to any queries I have, and she leaves me assured that my investments are in good hands. I highly recommend Wilcocks & Wilcocks for anyone looking for sound financial planning and advice.

Sophie Aysha Green

Sophie Aysha Green

When I first approached Martin I had a very limited understanding of savings and investments. He provided clarity, assurance and a clear plan to allow me to save and invest on terms that I felt comfortable with. The ongoing administrative support from Mary has been exceptional, she provides very quick replies to any queries I have, and she leaves me assured that my investments are in good hands. I highly recommend Wilcocks & Wilcocks for anyone looking for sound financial planning and advice.

I had too much of my pension sat in fixed income, not doing that much, and Martin reversed the strategy applying more stocks. I was initially a bit nervous but the evidence I was shown gave me confidence and all being well we will see a boosted return over the years.

James McCann

James McCann

I had too much of my pension sat in fixed income, not doing that much, and Martin reversed the strategy applying more stocks. I was initially a bit nervous but the evidence I was shown gave me confidence and all being well we will see a boosted return over the years.

One of the best things I have ever done for me and my family is introduce them to Martin to deal with their estate planning.

Carla Russell

Carla Russell

One of the best things I have ever done for me and my family is introduce them to Martin to deal with their estate planning.

I have been a client for a long time, they have been great and recently Martin helped me through a difficult time. Always at the end of the phone if I have needed them, and always explain things in a way that I can understand, so I highly recommend.

Jill McCrorie

Jill McCrorie

I have been a client for a long time, they have been great and recently Martin helped me through a difficult time. Always at the end of the phone if I have needed them, and always explain things in a way that I can understand, so I highly recommend.

He helped me make sense of my pensions, put them all in one place and on the back of it arranged wills and a family trust to look after our two sons when we have gone".

John Woodward

John Woodward

He helped me make sense of my pensions, put them all in one place and on the back of it arranged wills and a family trust to look after our two sons when we have gone".

We were in limbo with no financial plan and then we met Martin and everything changed. We have our pensions sorted, wills in place and everything is in place that we need to secure our future.

JON MCHALE

JON MCHALE

We were in limbo with no financial plan and then we met Martin and everything changed. We have our pensions sorted, wills in place and everything is in place that we need to secure our future.

Helen and I would like to thank Martin for the advice around our retirement and financial plans and as far as his investment solution is concerned it was a no-brainer.

NIGEL LACEY

NIGEL LACEY

Helen and I would like to thank Martin for the advice around our retirement and financial plans and as far as his investment solution is concerned it was a no-brainer.

Prior to meeting Martin Wilcocks, I had very little faith in financial advisers due to previous experiences. Martin is honest and transparent and he has restored my faith.

MARK FOSTER

MARK FOSTER

Prior to meeting Martin Wilcocks, I had very little faith in financial advisers due to previous experiences. Martin is honest and transparent and he has restored my faith.

A very knowledgeable, approachable and likeable professional. I would recommend to anyone looking for financial advice.

MATTHEW HYAM

MATTHEW HYAM

A very knowledgeable, approachable and likeable professional. I would recommend to anyone looking for financial advice.

His advice has been excellent and he is always there for us if we ever need him.

PHIL O’NEILL

PHIL O’NEILL

His advice has been excellent and he is always there for us if we ever need him.

I felt confident that my finances were in good hands and that Martin and Rob would help with any worries I might have, which indeed they have.

MARY ELSON

MARY ELSON

I felt confident that my finances were in good hands and that Martin and Rob would help with any worries I might have, which indeed they have.

Martin manages my pension and retirement plan and I am very happy with the good work he is doing.

DR NAVAID ALAM

DR NAVAID ALAM

Martin manages my pension and retirement plan and I am very happy with the good work he is doing.

I found Martin to be competent and professional.

DR RICHARD AZURDIA

DR RICHARD AZURDIA

I found Martin to be competent and professional.

I've known Martin Wilcocks for years and years, he knows his stuff and is a really great guy to work with.

ROY JOHNSON

ROY JOHNSON

I've known Martin Wilcocks for years and years, he knows his stuff and is a really great guy to work with.

Excellent service from the team.

Elaine Cooper

Elaine Cooper

Excellent service from the team.

I cannot tell you how much I appreciate what Martin has done for my family. He has gone above and beyond in the most honourable way. He is an absolute credit to his profession.

Michelle Moore

Michelle Moore

I cannot tell you how much I appreciate what Martin has done for my family. He has gone above and beyond in the most honourable way. He is an absolute credit to his profession.

“Martin is the consummate professional who has always delivered for myself and my business partner Joe Dwek CBE.”

ROY KENNY

ROY KENNY

“Martin is the consummate professional who has always delivered for myself and my business partner Joe Dwek CBE.”

“He provided very good advice on how to fund our pensions through the company to save Corporation Tax.”

ADAM MULLIN

ADAM MULLIN

“He provided very good advice on how to fund our pensions through the company to save Corporation Tax.”

“Martin is a breath of fresh air, explains things properly and his advice has been first class.”

ROSS BAIGENT

ROSS BAIGENT

“Martin is a breath of fresh air, explains things properly and his advice has been first class.”

“We insured our shareholdings, and through a trust it allows the four of us to buy back each other’s shares on death, or illness, which is very important for the company to keep control, but also for our families, who receive the value of each shareholding as a lump sum.”

STEVE DUNN

STEVE DUNN

“We insured our shareholdings, and through a trust it allows the four of us to buy back each other’s shares on death, or illness, which is very important for the company to keep control, but also for our families, who receive the value of each shareholding as a lump sum.”

“We know exactly how much money we need to build within our financial and retirement plan to achieve our future income goals.”

COLLIN DORAN

COLLIN DORAN

“We know exactly how much money we need to build within our financial and retirement plan to achieve our future income goals.”

“We consolidated a batch of old pensions that I had built up over the years. Alongside that, if I was to be seriously ill the business profit would drop so we arranged key man insurance for 2 years profit if the worst happens. Working with Martin has been a great move for us.”

JEFF ARNOLD

JEFF ARNOLD

“We consolidated a batch of old pensions that I had built up over the years. Alongside that, if I was to be seriously ill the business profit would drop so we arranged key man insurance for 2 years profit if the worst happens. Working with Martin has been a great move for us.”

“Martin tidied up and consolidated 5 old pensions and I now understand where they invest, what I pay in charges and how much they will provide in retirement. I can’t recommend him highly enough.”

CHRIS MOSS

CHRIS MOSS

“Martin tidied up and consolidated 5 old pensions and I now understand where they invest, what I pay in charges and how much they will provide in retirement. I can’t recommend him highly enough.”

“He handles our investments and pensions. We are very happy and value Martin’s advice which has also more recently involved us making a will and business trust and in also appointing powers of attorney.”

BALAZS & KATE HORVATH

BALAZS & KATE HORVATH

“He handles our investments and pensions. We are very happy and value Martin’s advice which has also more recently involved us making a will and business trust and in also appointing powers of attorney.”

“Martin arranged the finance I needed to buy the White Lion Pub – the last free house on the Wirral. It had always been in my plan but due to banks not funding pubs I was stuck and Martin sorted it.”

ANDY COCKRAM

ANDY COCKRAM

“Martin arranged the finance I needed to buy the White Lion Pub – the last free house on the Wirral. It had always been in my plan but due to banks not funding pubs I was stuck and Martin sorted it.”

“Martin gave me sound and simple investment advice that made sense and within my financial plan we have also worked out when I can retire and buy my sailing boat.”

STEPHEN LACEY

STEPHEN LACEY

“Martin gave me sound and simple investment advice that made sense and within my financial plan we have also worked out when I can retire and buy my sailing boat.”

“Martin has spent time with the children so they understand our retirement financial plan. He has been a big help to our family in general.”

HELEN LACEY

HELEN LACEY

“Martin has spent time with the children so they understand our retirement financial plan. He has been a big help to our family in general.”

“Every client we have passed to Martin has been very happy. It’s not easy to find a good Financial Adviser and I think Martin has proved time and again he is one of the good guys.”

BEN EDWARDS

BEN EDWARDS

“Every client we have passed to Martin has been very happy. It’s not easy to find a good Financial Adviser and I think Martin has proved time and again he is one of the good guys.”

“I was looking to work with a trustworthy and knowledgeable Financial Advisor, capable of dealing with our clients. Martin ticks the boxes on both counts, coupled with a high degree of professionalism and integrity.”

PAUL WHITE

PAUL WHITE

“I was looking to work with a trustworthy and knowledgeable Financial Advisor, capable of dealing with our clients. Martin ticks the boxes on both counts, coupled with a high degree of professionalism and integrity.”

“Martin is a competent financial adviser who stands out from the crowd.”

MICHAEL COLLINS

MICHAEL COLLINS

“Martin is a competent financial adviser who stands out from the crowd.”

“Martin is exceptionally accurate in everything that he says and does, I cannot find fault with his advice and I trust him absolutely in his judgement.”

ANDREW THOMPSON FCA

ANDREW THOMPSON FCA

“Martin is exceptionally accurate in everything that he says and does, I cannot find fault with his advice and I trust him absolutely in his judgement.”

“We couldn’t thank Martin enough for his time and the fact that he took personal ownership and pride in making sure we were happy with the pension and investment strategy.”

JON TAYLOR

JON TAYLOR

“We couldn’t thank Martin enough for his time and the fact that he took personal ownership and pride in making sure we were happy with the pension and investment strategy.”

“I took investment and pension advice from Martin. By working out my risk tolerances and setting up my investments he delivered a sound portfolio that I am confident with.”

DAVID TOURNAFOND

DAVID TOURNAFOND

“I took investment and pension advice from Martin. By working out my risk tolerances and setting up my investments he delivered a sound portfolio that I am confident with.”

“In handling our retirement plans, Martin explained how the world of money works and provided a hitherto unknown level of transparency.”

DAVID & ROSEMARY OWEN

DAVID & ROSEMARY OWEN

“In handling our retirement plans, Martin explained how the world of money works and provided a hitherto unknown level of transparency.”

“Martin gave me a very clear understanding of how he would transfer my pension and how it would be invested.”

DAMEON HULSE

DAMEON HULSE

“Martin gave me a very clear understanding of how he would transfer my pension and how it would be invested.”

“He invested for me and I’m very satisfied with his advice and management of my portfolio. I am very impressed with Martin and his dedication to his job. Well done. Keep up the good work.”

ROSEMARY COLCHESTER

ROSEMARY COLCHESTER

“He invested for me and I’m very satisfied with his advice and management of my portfolio. I am very impressed with Martin and his dedication to his job. Well done. Keep up the good work.”

“He explained his pension plan in full detail and went over every step that he would be taking to move across and manage my funds. I am very happy with Martin.”

SHERYL MOSS

SHERYL MOSS

“He explained his pension plan in full detail and went over every step that he would be taking to move across and manage my funds. I am very happy with Martin.”

“Martin is direct and gives you the facts as he sees them. He didn’t try to sway me to pick something with which I would have been uncomfortable.”

STEPHEN LINDEN & CATHY HOOD

STEPHEN LINDEN & CATHY HOOD

“Martin is direct and gives you the facts as he sees them. He didn’t try to sway me to pick something with which I would have been uncomfortable.”

“I took early retirement and wanted two pensions and an ISA amalgamated in a way that would fund my retirement. With Martin on board, we don’t see any problems achieving what we are aiming for.”

DAVE & ANN MCCANN

DAVE & ANN MCCANN

“I took early retirement and wanted two pensions and an ISA amalgamated in a way that would fund my retirement. With Martin on board, we don’t see any problems achieving what we are aiming for.”

“He provided peace of mind around retirement and our future income and everything was explained in a constructive manner, which included any possible downturns. Thank you for the advice its great to be on board.”

DAVE & LYNN MORRIS

DAVE & LYNN MORRIS

“He provided peace of mind around retirement and our future income and everything was explained in a constructive manner, which included any possible downturns. Thank you for the advice its great to be on board.”

“Since the day we had our first meeting with Martin he has demonstrated a personal and proactive approach. Hopefully, we are at the beginning of a very long and successful relationship with Martin and the team.”

ANDY & ANGELA PERRY

ANDY & ANGELA PERRY

“Since the day we had our first meeting with Martin he has demonstrated a personal and proactive approach. Hopefully, we are at the beginning of a very long and successful relationship with Martin and the team.”

My pension is in good hands and over the years I can say without any doubt that Martin is the best financial adviser I've come across.

Ian Cooke-McGuinness

Ian Cooke-McGuinness

My pension is in good hands and over the years I can say without any doubt that Martin is the best financial adviser I've come across.

When I first approached Martin I had a very limited understanding of savings and investments. He provided clarity, assurance and a clear plan to allow me to save and invest on terms that I felt comfortable with. The ongoing administrative support from Mary has been exceptional, she provides very quick replies to any queries I have, and she leaves me assured that my investments are in good hands. I highly recommend Wilcocks & Wilcocks for anyone looking for sound financial planning and advice.

Sophie Aysha Green

Sophie Aysha Green

When I first approached Martin I had a very limited understanding of savings and investments. He provided clarity, assurance and a clear plan to allow me to save and invest on terms that I felt comfortable with. The ongoing administrative support from Mary has been exceptional, she provides very quick replies to any queries I have, and she leaves me assured that my investments are in good hands. I highly recommend Wilcocks & Wilcocks for anyone looking for sound financial planning and advice.

I had too much of my pension sat in fixed income, not doing that much, and Martin reversed the strategy applying more stocks. I was initially a bit nervous but the evidence I was shown gave me confidence and all being well we will see a boosted return over the years.

James McCann

James McCann

I had too much of my pension sat in fixed income, not doing that much, and Martin reversed the strategy applying more stocks. I was initially a bit nervous but the evidence I was shown gave me confidence and all being well we will see a boosted return over the years.

One of the best things I have ever done for me and my family is introduce them to Martin to deal with their estate planning.

Carla Russell

Carla Russell

One of the best things I have ever done for me and my family is introduce them to Martin to deal with their estate planning.

I have been a client for a long time, they have been great and recently Martin helped me through a difficult time. Always at the end of the phone if I have needed them, and always explain things in a way that I can understand, so I highly recommend.

Jill McCrorie

Jill McCrorie

I have been a client for a long time, they have been great and recently Martin helped me through a difficult time. Always at the end of the phone if I have needed them, and always explain things in a way that I can understand, so I highly recommend.

He helped me make sense of my pensions, put them all in one place and on the back of it arranged wills and a family trust to look after our two sons when we have gone".

John Woodward

John Woodward

He helped me make sense of my pensions, put them all in one place and on the back of it arranged wills and a family trust to look after our two sons when we have gone".

We were in limbo with no financial plan and then we met Martin and everything changed. We have our pensions sorted, wills in place and everything is in place that we need to secure our future.

JON MCHALE

JON MCHALE

We were in limbo with no financial plan and then we met Martin and everything changed. We have our pensions sorted, wills in place and everything is in place that we need to secure our future.

Helen and I would like to thank Martin for the advice around our retirement and financial plans and as far as his investment solution is concerned it was a no-brainer.

NIGEL LACEY

NIGEL LACEY

Helen and I would like to thank Martin for the advice around our retirement and financial plans and as far as his investment solution is concerned it was a no-brainer.

Prior to meeting Martin Wilcocks, I had very little faith in financial advisers due to previous experiences. Martin is honest and transparent and he has restored my faith.

MARK FOSTER

MARK FOSTER

Prior to meeting Martin Wilcocks, I had very little faith in financial advisers due to previous experiences. Martin is honest and transparent and he has restored my faith.

A very knowledgeable, approachable and likeable professional. I would recommend to anyone looking for financial advice.

MATTHEW HYAM

MATTHEW HYAM

A very knowledgeable, approachable and likeable professional. I would recommend to anyone looking for financial advice.

His advice has been excellent and he is always there for us if we ever need him.

PHIL O’NEILL

PHIL O’NEILL

His advice has been excellent and he is always there for us if we ever need him.

I felt confident that my finances were in good hands and that Martin and Rob would help with any worries I might have, which indeed they have.

MARY ELSON

MARY ELSON

I felt confident that my finances were in good hands and that Martin and Rob would help with any worries I might have, which indeed they have.

Martin manages my pension and retirement plan and I am very happy with the good work he is doing.

DR NAVAID ALAM

DR NAVAID ALAM

Martin manages my pension and retirement plan and I am very happy with the good work he is doing.

I found Martin to be competent and professional.

DR RICHARD AZURDIA

DR RICHARD AZURDIA

I found Martin to be competent and professional.

I've known Martin Wilcocks for years and years, he knows his stuff and is a really great guy to work with.

ROY JOHNSON

ROY JOHNSON

I've known Martin Wilcocks for years and years, he knows his stuff and is a really great guy to work with.

Excellent service from the team.

Elaine Cooper

Elaine Cooper

Excellent service from the team.

I cannot tell you how much I appreciate what Martin has done for my family. He has gone above and beyond in the most honourable way. He is an absolute credit to his profession.

Michelle Moore

Michelle Moore

I cannot tell you how much I appreciate what Martin has done for my family. He has gone above and beyond in the most honourable way. He is an absolute credit to his profession.

Featured Client Stories

Simon O'Hara

As a pension investor, I found myself completely disillusioned with my previous provider. The returns were poor, the communication was non existent, and the entire experience felt faceless and impersonal. It was almost impossible to make sense of the chaotic way they applied my returns and whenever I needed assistance there was no one to speak to, just a huge, well known company incapable of providing any practical help. A couple of years ago, I decided enough was enough and set out to find "the best out there." I met with numerous financial advisors, ranging from large firms to smaller outfits. Then I had the pleasure of meeting Martin Wilcocks, and it didn’t take long into our conversation for me to realise he was different. Martin’s open-book transparency and genuine sincerity immediately put me at ease. Trust is everything to me, and I can honestly say I trust Martin completely. He has brought clarity and purpose to my investments, and taking a realistic stance on returns, I can confidently say they’ve far outperformed my previous arrangements. Beyond the numbers, I value Martin's ongoing support and the personal attention he brings to the table, qualities I never experienced before. I remain genuinely grateful to Martin for turning things around for me and for providing an investment experience I can finally feel confident in.

Marianne Lyon

After losing my husband in 2021 I was rudderless, and it is impossible for me to overstate just how incredibly helpful Martin has been since I was introduced to him. The challenges I faced were immense with unresolved conflicts between my late husband's executors prolonging the entire process of having his estate transferred to me. Unfortunately, those issues had not been addressed effectively by the solicitor handling the process, leaving me in limbo for over two years during an already incredibly painful time. Martin worked tirelessly, often pitted against a brick wall of unresponsive solicitors and family members and his perseverance in getting results against all odds has been nothing short of remarkable. As I write this review, approaching Christmas 2024, I can honestly say that Martin has completely turned things around over the past year and I can’t believe how much better he has made this Christmas for me, thank you Martin. I am so fortunate to have you as my adviser. Throughout the entire ordeal, you were always just a call or email away and you dealt with me kindly and patiently whilst I was fragile. The investment platform I now use is also incredibly easy to navigate (and I am terrible with technology!), which has been a huge relief too. I would highly recommend Martin and his team, including his sister and assistant Mary. Together, they are the best financial advisors anyone could wish for. Martin’s book is also an excellent resource for understanding his motivation and approach and tells you everything you need to know about him.

Liam Collins

I had been speaking with a number of people on ways to invest in value stocks that had lots of headway for growth but I was being encouraged to make it my full time gig to understand how to value companies, invest into them and then monitor them, and I wasn’t sure I had the time orinclination. I found Martin and straight away what he was saying made complete sense to me. Instead of trying to work out which value companies where the ones to watch he showed me how buying all of them within his fund did the job and banked the returns I was looking for. We also got into investing in smaller companies and I now have a portfolio that invests using tons of evidence. It feels right and makes sense to me. He started to dig deeper by talking about life in general and he was really interested in what I was looking to achieve in the wider sense and the penny soon started to drop that having him as my wingman was going to be really useful.

Professor Alison Ewing

Martin’s philanthropy is truly inspiring, and his newsletters are always personal and relevant. I had read many of his messages while I was still working and appreciated his book, which offered valuable insights. What ultimately led me to move my advice to Martin was the lack of enthusiasm my previous adviser showed when I received a retirement lump sum. The easy path was always taken, and when I retired, I started questioning the 'value for money' of the fees I was paying and felt somewhat let down. Martin’s website stood out to me and instilled confidence, and noticing a testimonial from someone I knew from my working days added another layer of trust. When I met Martin at his office, he came across as caring, sincere and concerned. I could see he was running a genuine family business and from our first meeting, I felt very comfortable and knew I could trust him. Martin is a details man, which is excellent in my book and he has given me a completely new perspective on investments and estate planning, enlightening and, admittedly, a little daunting at times! I know I’ve made the right decision moving my advice over to him and would happily endorse Martin to anyone seeking financial and investment guidance. I look forward to a long and mutually beneficial relationship. Thank you, Martin, for being so helpful and efficient.

Steve Austin

Having recognised I needed the help of an independent financial advisor, I set about a comprehensive search of who I believed I could work with, and who could provide the knowledge and guidance I needed. This search eventually led me to choose Martin Wilcocks at Wilcocks & Wilcocks. Following an initial meeting at their offices in Liverpool, I probably became one of Martin’s hardest challenges to win over, due to having several complex pension issues. Martin quickly provided an outline plan on how he saw best to resolve my situation. I was able to challenge and test Martin throughout this process to ensure I had the best solution possible. One of my other reasons for choosing Martin was that it's a family run business. When utilised effectively, I believe the power of a family working together to meet individual customers' specific needs, cannot be beaten and this has been proven to be the case thus far. To date they have exceeded my expectations, both with their service, as well as meeting the financial returns I expected, which in these uncertain times is not an easy task. My decision to go with them has proven to be the right one, and I look forward to working with the family throughout my retirement years.

Phil Myles

I’m based in the The UAE and UK and I was sitting with money in the bank earning nothing and some shares that I'd been building for a few years. I had met advisors in The UAE but investing there isn’t easy and doesn’t feel comfortable. I did some searching across the internet in the UK and I came across Martin through positive reviews online. I contacted him and some other advisors and he was very active and involved from the first contact and I soon decided this was the person I should speak to. We had a couple of video calls and I went to meet him on one of my trips back and felt very comfortable with some straightforward advice and explanations, no big claims of what could be achieved and a flexible approach. I’m very satisfied with Martin’s personal touch and the support from his wife and sister, gives a positive family feeling to the set up which is very professionally run. Pleasingly, they even carry that through to how my account is set up so I can set something aside for my daughters under the same umbrella. I have no hesitation in recommending Martin and his team.

Betty Andrews

I read your book, and it was genuinely the most important book I had read in years. As someone who was nearing retirement after a career in Financial Services, it confirmed so many doubts I had about pensions and proved them right! The clarity it gave me was invaluable. I knew exactly what I needed to do to complete my plan, and it became a game changer for me and my husband. I recommended it to all my family and friends they simply couldn’t afford not to read it. Its now been a few months since John and I moved our pensions to you, and we couldn’t have been happier. You and Mary took such great care in gathering all the details from our previous providers, presenting clear recommendations, and ensuring we had all the information we needed to make informed decisions. We now have complete peace of mind knowing our funds were invested wisely. The platform is excellent offering up to date and historical performance at the touch of a button and it is so reassuring to be able to access this whenever we want.

Simon O'Hara

As a pension investor, I found myself completely disillusioned with my previous provider. The returns were poor, the communication was non existent, and the entire experience felt faceless and impersonal. It was almost impossible to make sense of the chaotic way they applied my returns and whenever I needed assistance there was no one to speak to, just a huge, well known company incapable of providing any practical help. A couple of years ago, I decided enough was enough and set out to find "the best out there." I met with numerous financial advisors, ranging from large firms to smaller outfits. Then I had the pleasure of meeting Martin Wilcocks, and it didn’t take long into our conversation for me to realise he was different. Martin’s open-book transparency and genuine sincerity immediately put me at ease. Trust is everything to me, and I can honestly say I trust Martin completely. He has brought clarity and purpose to my investments, and taking a realistic stance on returns, I can confidently say they’ve far outperformed my previous arrangements. Beyond the numbers, I value Martin's ongoing support and the personal attention he brings to the table, qualities I never experienced before. I remain genuinely grateful to Martin for turning things around for me and for providing an investment experience I can finally feel confident in.

Marianne Lyon

After losing my husband in 2021 I was rudderless, and it is impossible for me to overstate just how incredibly helpful Martin has been since I was introduced to him. The challenges I faced were immense with unresolved conflicts between my late husband's executors prolonging the entire process of having his estate transferred to me. Unfortunately, those issues had not been addressed effectively by the solicitor handling the process, leaving me in limbo for over two years during an already incredibly painful time. Martin worked tirelessly, often pitted against a brick wall of unresponsive solicitors and family members and his perseverance in getting results against all odds has been nothing short of remarkable. As I write this review, approaching Christmas 2024, I can honestly say that Martin has completely turned things around over the past year and I can’t believe how much better he has made this Christmas for me, thank you Martin. I am so fortunate to have you as my adviser. Throughout the entire ordeal, you were always just a call or email away and you dealt with me kindly and patiently whilst I was fragile. The investment platform I now use is also incredibly easy to navigate (and I am terrible with technology!), which has been a huge relief too. I would highly recommend Martin and his team, including his sister and assistant Mary. Together, they are the best financial advisors anyone could wish for. Martin’s book is also an excellent resource for understanding his motivation and approach and tells you everything you need to know about him.

Liam Collins

I had been speaking with a number of people on ways to invest in value stocks that had lots of headway for growth but I was being encouraged to make it my full time gig to understand how to value companies, invest into them and then monitor them, and I wasn’t sure I had the time orinclination. I found Martin and straight away what he was saying made complete sense to me. Instead of trying to work out which value companies where the ones to watch he showed me how buying all of them within his fund did the job and banked the returns I was looking for. We also got into investing in smaller companies and I now have a portfolio that invests using tons of evidence. It feels right and makes sense to me. He started to dig deeper by talking about life in general and he was really interested in what I was looking to achieve in the wider sense and the penny soon started to drop that having him as my wingman was going to be really useful.

Professor Alison Ewing

Martin’s philanthropy is truly inspiring, and his newsletters are always personal and relevant. I had read many of his messages while I was still working and appreciated his book, which offered valuable insights. What ultimately led me to move my advice to Martin was the lack of enthusiasm my previous adviser showed when I received a retirement lump sum. The easy path was always taken, and when I retired, I started questioning the 'value for money' of the fees I was paying and felt somewhat let down. Martin’s website stood out to me and instilled confidence, and noticing a testimonial from someone I knew from my working days added another layer of trust. When I met Martin at his office, he came across as caring, sincere and concerned. I could see he was running a genuine family business and from our first meeting, I felt very comfortable and knew I could trust him. Martin is a details man, which is excellent in my book and he has given me a completely new perspective on investments and estate planning, enlightening and, admittedly, a little daunting at times! I know I’ve made the right decision moving my advice over to him and would happily endorse Martin to anyone seeking financial and investment guidance. I look forward to a long and mutually beneficial relationship. Thank you, Martin, for being so helpful and efficient.

Steve Austin

Having recognised I needed the help of an independent financial advisor, I set about a comprehensive search of who I believed I could work with, and who could provide the knowledge and guidance I needed. This search eventually led me to choose Martin Wilcocks at Wilcocks & Wilcocks. Following an initial meeting at their offices in Liverpool, I probably became one of Martin’s hardest challenges to win over, due to having several complex pension issues. Martin quickly provided an outline plan on how he saw best to resolve my situation. I was able to challenge and test Martin throughout this process to ensure I had the best solution possible. One of my other reasons for choosing Martin was that it's a family run business. When utilised effectively, I believe the power of a family working together to meet individual customers' specific needs, cannot be beaten and this has been proven to be the case thus far. To date they have exceeded my expectations, both with their service, as well as meeting the financial returns I expected, which in these uncertain times is not an easy task. My decision to go with them has proven to be the right one, and I look forward to working with the family throughout my retirement years.

Phil Myles

I’m based in the The UAE and UK and I was sitting with money in the bank earning nothing and some shares that I'd been building for a few years. I had met advisors in The UAE but investing there isn’t easy and doesn’t feel comfortable. I did some searching across the internet in the UK and I came across Martin through positive reviews online. I contacted him and some other advisors and he was very active and involved from the first contact and I soon decided this was the person I should speak to. We had a couple of video calls and I went to meet him on one of my trips back and felt very comfortable with some straightforward advice and explanations, no big claims of what could be achieved and a flexible approach. I’m very satisfied with Martin’s personal touch and the support from his wife and sister, gives a positive family feeling to the set up which is very professionally run. Pleasingly, they even carry that through to how my account is set up so I can set something aside for my daughters under the same umbrella. I have no hesitation in recommending Martin and his team.

Betty Andrews

I read your book, and it was genuinely the most important book I had read in years. As someone who was nearing retirement after a career in Financial Services, it confirmed so many doubts I had about pensions and proved them right! The clarity it gave me was invaluable. I knew exactly what I needed to do to complete my plan, and it became a game changer for me and my husband. I recommended it to all my family and friends they simply couldn’t afford not to read it. Its now been a few months since John and I moved our pensions to you, and we couldn’t have been happier. You and Mary took such great care in gathering all the details from our previous providers, presenting clear recommendations, and ensuring we had all the information we needed to make informed decisions. We now have complete peace of mind knowing our funds were invested wisely. The platform is excellent offering up to date and historical performance at the touch of a button and it is so reassuring to be able to access this whenever we want.

Simon O'Hara

As a pension investor, I found myself completely disillusioned with my previous provider. The returns were poor, the communication was non existent, and the entire experience felt faceless and impersonal. It was almost impossible to make sense of the chaotic way they applied my returns and whenever I needed assistance there was no one to speak to, just a huge, well known company incapable of providing any practical help. A couple of years ago, I decided enough was enough and set out to find "the best out there." I met with numerous financial advisors, ranging from large firms to smaller outfits. Then I had the pleasure of meeting Martin Wilcocks, and it didn’t take long into our conversation for me to realise he was different. Martin’s open-book transparency and genuine sincerity immediately put me at ease. Trust is everything to me, and I can honestly say I trust Martin completely. He has brought clarity and purpose to my investments, and taking a realistic stance on returns, I can confidently say they’ve far outperformed my previous arrangements. Beyond the numbers, I value Martin's ongoing support and the personal attention he brings to the table, qualities I never experienced before. I remain genuinely grateful to Martin for turning things around for me and for providing an investment experience I can finally feel confident in.

Marianne Lyon

After losing my husband in 2021 I was rudderless, and it is impossible for me to overstate just how incredibly helpful Martin has been since I was introduced to him. The challenges I faced were immense with unresolved conflicts between my late husband's executors prolonging the entire process of having his estate transferred to me. Unfortunately, those issues had not been addressed effectively by the solicitor handling the process, leaving me in limbo for over two years during an already incredibly painful time. Martin worked tirelessly, often pitted against a brick wall of unresponsive solicitors and family members and his perseverance in getting results against all odds has been nothing short of remarkable. As I write this review, approaching Christmas 2024, I can honestly say that Martin has completely turned things around over the past year and I can’t believe how much better he has made this Christmas for me, thank you Martin. I am so fortunate to have you as my adviser. Throughout the entire ordeal, you were always just a call or email away and you dealt with me kindly and patiently whilst I was fragile. The investment platform I now use is also incredibly easy to navigate (and I am terrible with technology!), which has been a huge relief too. I would highly recommend Martin and his team, including his sister and assistant Mary. Together, they are the best financial advisors anyone could wish for. Martin’s book is also an excellent resource for understanding his motivation and approach and tells you everything you need to know about him.